The Age of Sustainable Progress

In an economic paradigm running on the dividends of 20th century innovation, it's now time to reaccelerate.

TL;DR

Given the current geopolitical and inflationary backdrop, it has now become a bit of a contrarian thought to claim that the progress we’ve collectively enjoyed since the post-war period has been staggering. However, gains across life expectancy, reductions in communicable diseases, vast improvements in technology and the dividends from the Western Hemisphere’s Pax Americana have collectively generated the fastest positive acceleration in human history. These advances have improved the quality of life of billions.

The rate of progress since the 1920s has been staggering. Advances in technology, infrastructure, and industry have transformed our world, driving unprecedented economic growth and improving the quality of life for billions. However, it appears we are now coasting on the dividends of this previous period of innovation and expansion. As the fruits of past efforts begin to wane, the urgency to discover new growth engines becomes ever more critical.

The next chapter of global development hinges on our ability to make substantial investments in hard industrials and bring about an abundance of intelligence and energy. To build upon this tremendous progress, preserve the American Dream and create a foundation for prosperity for all, the key will be to fundamentally overhaul our systems of production. This transition not only addresses the pressing need for economic revitalization, but also aligns with sustainability. The challenge is clear: we must leverage innovation and capital to forge a new era of industrial advancement, one that aligns with environmental imperatives and economic ambitions alike.

Key ideas explored in this writeup:

1. The decoupling of America and its innovation engine

2. The greatest challenge of our century

3. (Re)accelerationism

4. Thoughts on what to fund, and what shouldn’t be funded

In the timespan since 1970, the world’s GDP grew from $3 trillion to $100 trillion. Global poverty rates dropped from a staggering 60% to a mere 15%. And at the current rate of fertility, humankind will continue its relentless population growth to reach 10 billion people by 2050.

This remarkable progress largely relied on the dividends of 20th-century research and industrial growth. It simultaneously benefited from the greatest increase in collective output ever, with globalization and digital interconnectivity rising. Breakthroughs in fields such as medicine, transportation, and communication laid the foundation for the modern world. The development of integrated circuits and microprocessors enabled the proliferation of computers, smartphones, and countless other digital devices, creating a foundation for the Information Age. The era of cheap energy unlocked rapid industrial expansion and economic growth. With the acceleration in world trade, raw materials accessibility facilitated large-scale manufacturing and infrastructure development.

This resource-abundant environment allowed industries to thrive and innovate for the last 50 years or so.

During this period, our economies operated largely in an unconstrained resource environment. The focus was on maximizing output-per-dollar, often overlooking externalities such as environmental degradation and long-term sustainability. If a resource was running low, we would simply look for the next source of it across the world.

The decoupling of America’s innovation engine

It’s no secret that the systems of production behind our economy largely rely on pollutive and extractive processes set in the early to mid-1900s. The time since has been mostly characterized by a lack of fundamental breakthroughs, a reduction in innovations and scientific discoveries brought to consumers. We’ve been coasting on the dividends of our past greatness, so to speak. Or perhaps simply spending our collective attention and talent on other, more pressing opportunities, such as the transition of business processes and data to the cloud.

For the last 30 years, exponential growth has not taken place in the primary and secondary sectors of our economies, leaving energy production, food production and transportation largely unchanged. We’ve had very few ‘Moore’s law’ levels of progress in those areas. Our domestic industrial base shrank, leading to a decline in local innovation and technological advancement.

The WSJ wrote a great article on the topic of this stagnation, highlighted a few tangible examples:

A large part of the world’s electricity is generated by steam turbines - Their efficiency has improved by only 1.5% over the last 100 years.

The growth in battery energy density since 1900 has averaged 2% a year. Boo.

Rice harvests in Asia have increased at 1% per year.

The annual decline in energy use for steel production averaged less than 2% since the 1950s.

The American economist Tyler Cowen dubbed our current era the “Great Stagnation”. In his essay, he argues that America has reached a technological plateau, reaching full potential from the previous era of innovation. By the 2000s, no low-hanging fruits were left, and the country seemingly lost its way around innovation.

Even worse, the country underinvested in the deployment of some of its core achievements: President Nixon had publicly pushed for the financing of 1,000 nuclear plants by year 2000 to provide 200% of the US’s forecasted electricity needs by… 2022. But only 93 were built. Imagine not even having to rebuild our electricity grid to unleash the full potential of AI… That headache could have been avoided.

In this context, a wave of ‘spleen’ has kicked in, with 1960s nostalgia fully entering pop culture, from fashion trends all the way to Founder Fund’s latest promotional video. We’re collectively looking back and exclaiming a deep “where did we go wrong?” scream. How did we go from launching men on the moon to defunding the NASA? A recent visit to Kennedy Space Center, 13 years after having attended the launch of the last Space Shuttle during a summer exchange program, made me face the lack of interest that we’ve collectively had in hard innovation.

While a comprehensive explanation isn’t the topic of this writeup, a few reasons can be pointed out:

First, the federal government significantly decreased its R&D budget from 1.2% of GDP in 1976 to 0.8% in 2016. Adjusted for inflation in research costs, the reduction is even more drastic. A study by Milton found a five-fold increase in expenditures per technical person between 1920 and 1964, indicating that the amount of intellectual capital dedicated to research dropped drastically.

Second, we met cost curves that made the diffusion of certain innovations uneconomical at first. Our industrial sector failed to innovate on its inputs as it did in the previous century, continuing to use the same materials. For instance, polyethylene, the most common plastic, was invented in 1898 in a German lab. The Hall-Héroult process, discovered independently by Charles Martin Hall and Paul Héroult in 1886, made industrial-scale aluminum production possible. Since these early innovations, there has been limited advancement in the fundamental materials used in industry.

Third, America’s industrial sector, which had largely benefited from access to cheap energy, faced an inflation crisis in the 1970s. This economic shift made domestic production less competitive, prompting industries to relocate to countries with more favorable cost structures, such as Japan, and later China and South Korea.

As a result, free cash flow (FCF) that could have been invested in domestic research and development (R&D) was instead directed towards capital expenditures (Capex) for expanding operations internationally. This focus on global expansion over domestic innovation further decoupled the American innovation engine, as manufacturing and production centers moved abroad.

Fourth, America benefited from a boom in the labor pool after World War II, with the baby boomers entering the workforce in the 1960s. Coupled with the transformation of the wartime military industrial complex into domestic manufacturing capacity, America enjoyed a surge in its GDP growth rate. Women massively joined the workforce at the same time, further expanding the demographic tailwind.

The greatest challenge of our century

As we deal with the impacts of these historical changes, we confront a new challenge: the climate crisis. The world is gradually recognizing an external cost connected to our climate that we hadn't accounted for before. we are now on course to alter what has been a relatively stable climate over the 10,000 years of human civilization.

The rate of climate change is orders of magnitude above any in the last 65 million years. Temperature anomalies have become an uncomfortable norm in recent summers. For example, in September 2023, the ocean temperature anomaly value (+1.87°F) reached a new all-time record. It is no longer just about videos of penguins running across dislocating icecaps; we are now faced with the need to adapt our consumption patterns and habits to increasingly frequent and severe extreme weather events.

In a 2023 paper, scientists attempted to quantify the level of primary production at which we would be able to maintain our current environment and biosphere equilibrium. They created a framework across 9 boundaries, including ocean acidity levels, co2 concentration, and biogeochemical flows. They found that 6 of the 9 boundaries had already been crossed.

Alongside historical macro trends, the phenomena of urbanization and rapid population growth are fundamentally altering our resource consumption patterns, edging us closer to the brink of scarcity. Newly breached technological frontiers, such as generative AI, will create unprecedented strains on our underinvested electricity grid (gigawatts hour of demand for incremental data center needs alone).

The pace of progress has traditionally depended on the cost of energy, ease of access to raw materials and our ability to efficiently convert these elements into outputs. If we don’t rewire the way we build things, some of the key gains in global well-being could be reversed. A staggering data point confirms this: According to EDGAR, material productivity (defined as GDP $$ for each kg of material used) has been the slowest grower amongst labor productivity, energy and GHG productivity in recent decades. The analysis is uncompromising: In the past 10 years, Western economies have failed to increase their manufacturing productivity, remaining glued around Pre-2007 levels.

The timing is now to transform our trajectory: 4.8 billion people could be facing water scarcity by 2050. Earth overshoot day, which marks the date we have used more than our planet can produce in a year, is now falling on August 2nd. Ecological limits could soon become central to political and consumer-decision making. But this piece is not about picturing doomsday scenarios and virtue signaling – Instead, it brings us to the biggest opportunity of our century, which promises to catalyze human innovation to break current constraints and unleash a new era of sustainable progress.

The stakes are high: the status-quo in business operations, marked by disrupted supply chains and fluctuating commodity prices in the last 2 years, is becoming increasingly unsustainable, impacting company bottom lines and generating stronger core inflation. Trade tariffs and deglobalization will likely lead to a deadweight loss resulting in higher costs for customers, an econ 101 intro class topic. A Goldman Sachs economist found that proposed tariffs from the GOP’s 2024 platform would increase core inflation rate by 1.1%. Regardless of political affiliations, these trends are all pointing to a massive wave of reindustrialization across Western economies. Rapid technological innovation will be the key to both reduced inflation and improved sustainability.

(Re)accelerationism: The opportunity, and where it lies

Our progress may have stalled, but the imperative to innovate has never been clearer. The transition to a decarbonized economy represents not only a necessity but also an opportunity to lead the next wave of global progress. Through strategic investments and a renewed commitment to research and development, we can overcome the greatest challenge of our century and continue the trajectory of human advancement.

I would not be surprised if 30 years from now, we will look back at the 1990s-2020s period and think:

Not much innovation happened in that period on a relative basis.

Some of the production systems will look plain decadent and inefficient. Just like how we look at the coal-based industry today.

Creating a sustainable environment to allow humanity to continue to prosper is, undoubtedly, our era’s greatest challenge and opportunity. We have a collective imperative to support population growth while ensuring that everyone can live in the best possible conditions.

Behind this opportunity, the risk of stalling progress looms large, due to finite resources. The previous eras of technological surge (industrial revolution, steam and railways, steel & heavy engineering, oil & automobile) and pace of acceleration could have looked very different in an environment faced with resource scarcity.

This context sets the stage for the next innovation cycle, one that seeks to create abundant, renewable resources, thereby unleashing human progress and removing any barriers on the near horizon.

The essence of the investment thesis revolves around identifying and nurturing businesses that enable this paradigm shift, particularly those that drive 'green premiums' into negative territory. The opportunity is incredibly large too. In its 2024 call for startups, Y Combinator highlighted that the opportunity in climate tech could be worth $3-$10 trillion in EBITDA. Some have begun to call the climate transition the 6th industrial wave.

The systems of production behind our society will need to shift to adapt to the urgency of our climate crisis. “Progress” means a paradigm shift, implying technology going much further than the current status-quo to drive true change without compromising on recently secured societal gains.

Significant shifts in industry cycles require distinct driving forces to succeed and act as disruptors, emphasizing the importance of a well-timed "why now". My experience at Ara Labs exemplifies this. The company ventured into the in-car economy a decade prematurely, anticipating a future where autonomous vehicles would create new in-car ecosystems centered around essential human activities.

Luckily for us, the early 2020s brought to life a wealth of catalysts to power that change. Therefore, while the trend of innovation in production processes have not been all that impressive, recently breached technical barriers promise to unlock a flurry of innovations.

We’ve also ridden multiple cost curves down in that timeframe, enabling new business models to become viable in 2024 (from the same Leo Polovet’s blog as above)

· Solar panels are 10x cheaper per watt1 and 1.5x-2x more efficient.2

· Lithium-ion batteries are 10x cheaper3 and 10x more energy dense.4

· LiDAR is about 100x cheaper.5

· GPUs are 1000x cheaper per GFLOP6 and 2000x more powerful.7

· Genome sequencing is 100,000x cheaper (!!) and gene synthesis is 100x cheaper.8

· Launching a kilogram into space is 10x cheaper.9

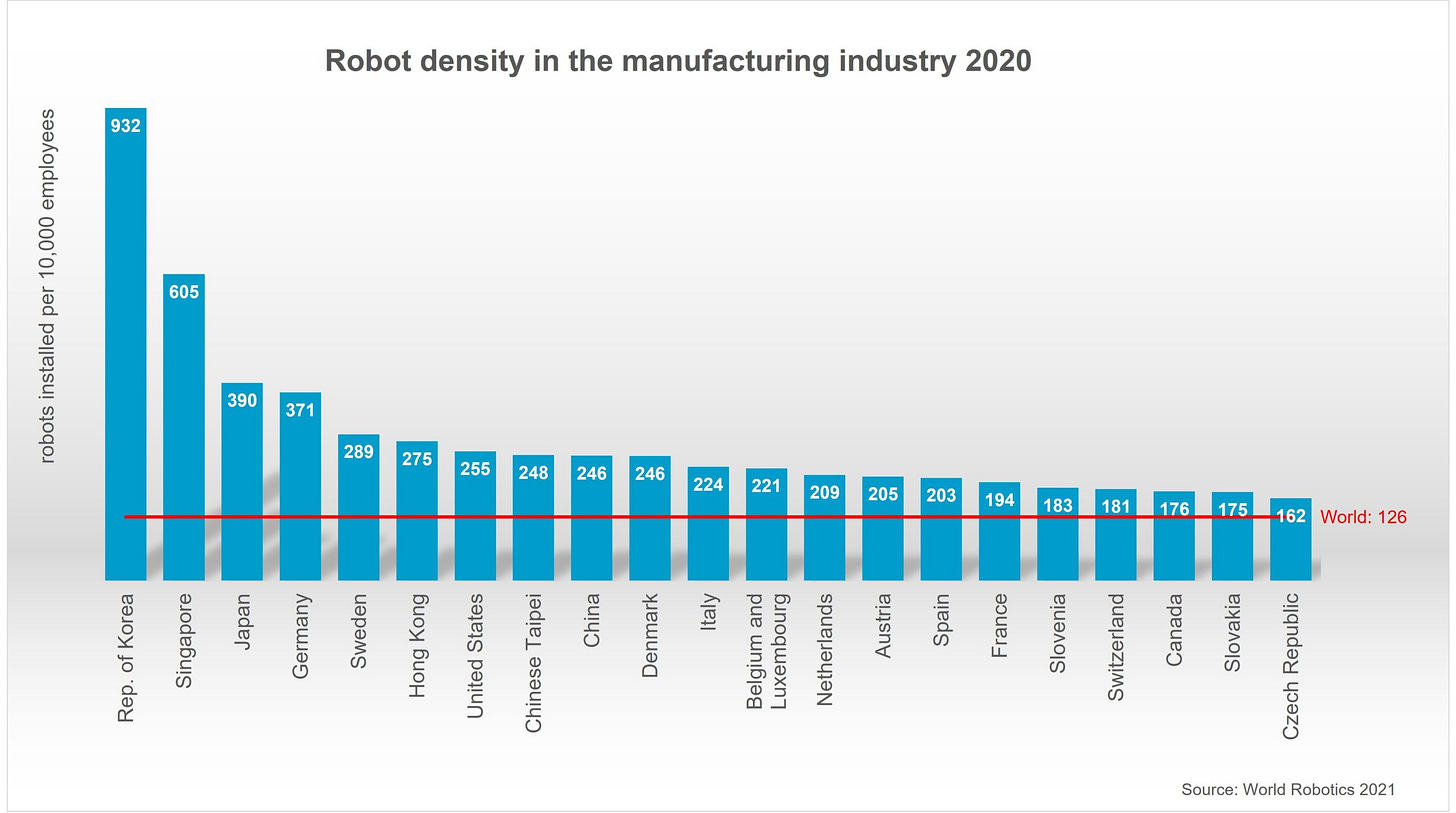

· Industrial robots are 100x more precise than 40 years ago, 5x cheaper than 20 years ago.10

· Hard drives and RAM are each 40x cheaper and much higher capacity.11 And there are amazing options if you’re space constrained (a few of these in 2004 vs one of these in 2024).

Is this cleantech hype 2.0? No.

The late 2000s clean tech boom and bust served to establish the basis for the current cycle. The pioneers behind it were not wrong in saying that “going green could be the biggest economic opportunity of the 21st century” (A quote from legendary KPCB’s John Doerr), they were just a decade early. But the billions invested served to attract the talent base and financing solutions. We are now able to leverage this infrastructure for the next generation of innovation.

The mid-2020s offers significantly improved conditions to drive a wave of technological innovation across our hard sectors. With software having reached later phases of its development and installation cycle, the attention of early-stage investors has now largely shifted to hard tech and deep tech innovation, bringing a wealth of capital to implement the derisked science of the 2010s. In Europe, climate tech investing is one of the most resilient sectors following the 2021 peak of venture investing. In the United States, venture capital money is slowly dripping into deep tech innovation again, with sectors such as manufacturing and defense seeing record funding levels.

And this time, sustainability interests are intermeshed with some of the largest and most lucrative investment opportunities of the decade, The current CAPEX cycle behind the unleashing of artificial intelligence will lead to vast investments in clean energy and grid connectivity. According to a recent Goldman Sachs report, the private sector is about to unleash $1 trillion in CAPEX for AI ramp up by the turn of the decade. Those new data centers will require tremendous energy volumes to run and for the first time, clean energy (especially solar) presents the best potential scalability and pricing, while nuclear is offering the most scalable long term solution.

Other key drivers of this new phase of innovation include:

The imperative of net-zero laws and the incentives created by government tax credits and carbon accounting, including the Inflation Reduction Act’s $1.7 trillion for climate initiatives in the US. These are more efficiently connecting companies to their climate related externalities through a mix of incentives and penalties.

The evolving preferences of consumers towards more sustainable choices, a true North for the broader economy, driving corporate commitments, especially in the consumer sector. As of 2023, 60% of the global assets have net zero targets, 40% of the materials sector, and 50% of the utilities sector.

The rise of climate unicorns, attracting talents and creating blueprints for large wealth creation.

In parallel, the emergence of a new generation of engineers, trained at the likes of SpaceX, Tesla, and Apple, who understand how to develop hardware cost efficiently and rapidly. Hardware startups are becoming “sexy” again in the silicon valley.

A US infrastructure system living on borrowed time: In private water utilities alone, the EPA says that the US will face $470Bn in costs over the next 20 years to upgrade its water infrastructure alone.

The emergence and standardization of a new system of records, penalties and incentives, around co2 emissions, progressively having a bottom line impact on corporations (EU-UTS requirements in Europe, for instance).

An increase in funding mechanisms and non-dilutive financing, notably at the state level, to address the front-loaded technical risk of hardware.

A rising willingness to embrace private sector innovation from public entities.

There is an alignment of several datapoints indicating a shift in the current status-quo: New manufacturing order volumes are growing again. The US manufacturing PMI was 50.3 last month (March 2024), reaching its highest level in the last 16 months. Rare are the areas where we see bipartisan alignment, but American dynamism / reshoring production is one of them.

And change is also happening at the Federal level. The 2022 CHIPS act and the IRA both show that the US government is putting big bucks behind reshoring, which it sees as an opportunity to reinforce American economic hegemony in an increasingly polarized world. Even the US commerce secretary recently used the tagline “Make hardware sexy again”. Infrastructure, physical security, supply chain automation, commodity and energy sovereignty are top of the agenda again. With the ADVANCE Act looming into law, it’s obvious that the sentiment behind nuclear fission is the strongest it’s been this century.

Addressing the skilled labor gap

When we look at the reasons why production systems moved away from the West towards Asia, cost-of-labor arbitrage is a fundamental part of the answer. Other elements to complement it were rising payrolls due to Union pressure, increasingly restrictive regulatory frameworks, and rapidly decreasing shipping costs. One of the keys behind a re-shoring movement that doesn’t trigger heightened inflation lies in our ability to increase the number of skilled worker hours available domestically.

Current labor and demographic trends are working against us: We’re facing a recent decrease in the labor force participation rate, and the “great labor reshuffle” has redistributed our workforce. During the pandemic, 1.4M jobs were lost, and 622K still haven’t been filled since in the manufacturing sector. The skilled workforce in traditionally physical jobs has dropped because of Baby Boomers leaving for their retirement, and they are not being replaced. Beyond that, the US Census Bureau projects an even more alarming trend: The US population is likely to decline by 2080. Lower immigration scenarios bring this peak 30 years earlier, in 2050. This is an incredible essential risk to our economic stability, one that we will need to solve if we want to reignite sustainable growth.

With the rise of robotics, we see a direct path to reducing the arbitrage to a level that will propel a shift back towards ‘Made in the West’, and a mitigating factor to the looming demographic crisis. The robotization of our economy is essential, and a key investment opportunity that is now unlocked by recent progress in 5g connectivity and artificial intelligence will lead to an inevitable wave of deployment. It is easy to envision a world with more robots than humans, from general purpose humanoids to task-specific robots.

3 main categories are worth following in the space:

Robotics developers, which will build robots from industrial applications all the way to personal use

Robotics enablers: Focused on the technologies that power these robots across 3D modeling, AI-based decision making and machine vision, and motion control

Robotics operations and maintenance: The supply chain that will need to be created to run and sustain this new workforce

Critical materials are more critical than ever

Of course, to power all of this innovation within a larger macro trend of deglobalization, attention will need to be put on our strategic supply chain. Chinese refineries, in particular, control up to 90% of the volume in certain critical clean energy metals. There are major implications for our supply chains if China becomes excluded from the equation.

Recent disruptions and cost volatility in containerized shipping, coupled with geopolitical instability, have made shipping and the associated longer lead times a significant supply chain risk. Opportunities to reshore rare magnets production (essential for electric cars and wind turbines, for instance) and battery supply chain elements (lithium, copper, nickel…) are already starting to abound. More specifically, new techniques such as synthetic biology – as evidenced by the use of microbes to extract lithium from low grade brines – will allow to create new sustainable inputs, locally.

The sustainable techno-industrial revolution (or STI – An unfortunate acronym)

Behind these macro-trends, there are several enabling technologies that have reached or will reach in the near term the level of maturity needed for large scale deployment:

Advances in computing power and storage, enhancing the ability to process and analyze vast datasets for deeper insights and improved forecasting.

The proliferation of physical world sensors and satellite imagery, significantly improving our ability to monitor environmental changes with greater precision and frequency. With that, the reduction of the cost per kg sent to space, enabling a new generation of satellites.

Innovations in CRISPR and synthetic biotechnology, enabling customization of materials and inputs for specific needs, as well as biomining and bio manufacturing.

The integration of IoT and cheap high-speed internet, fundamentally altering the landscape of industrial production and broader connectivity to bring intelligence to the edge.

Developments in advanced manufacturing, spatial computing, robotics, and 3D printing, which are liberating the workforce from repetitive manual tasks.

The emergence of more economical battery and motor technologies, pivotal in the shift to sustainable energy sources.

The utilization of generative AI and machine learning, empowering computers to synthesize and correlate vast amounts of information, increasing the rate of learning for robotic and self-driving systems.

Now is the time to build in those verticals and unlock the vast potential promised by the emergence of these technologies. I’m very excited to meet any founder looking for an active, high-conviction fund to unlock the next era of sustainable progress at scale.

The revamping of our industrial base will require a combination of novel technologies with lean manufacturing processes. It’s not just about total capacity, but also about the efficiency of our production systems. The more efficiently we can transform matter (shape and mechanical properties), the more sustainable our industrial base will become.

A simple equation can be used to understand where and how we need to spend our time to overhaul our industrial base:

Where:

T: Technological advancement.

E(T): Efficiency as a function of technology.

L(T): Labor cost as a function of technology.

Cᵣ: Raw material cost.

Cₘ(T): Overall manufacturing cost as a function of technology.

Source: The techno industrialist manifesto

Mass cattle production is a great example of a process that looks highly optimized now, but will likely become obsolete with technology. Growing a whole cow to slaughter it 18 months later for meat will look very stupid once lab-grown meat becomes the new status-quo. And make no mistake, I love meat…

At Bleu, we’ve already started to apply those beliefs in our investment strategy. We look for opportunities where inefficient processes can be redesigned with existing technology to drive efficiency improvements. Traces of that thesis can already be found in our more recent investments, including Hubcycle (food waste to value), Nova Carbon (composite recycling), Tekyn (on-demand production), La Vie (alt-foods), and For Days (enabling layer for circular fashion). My personal investments also include Exodys, a company recycling nuclear waste.

So, if you want to ride the next wave of innovation and improve each part of the equation above, opportunities will be found in new materials and chemicals discovery and production, energy inputs, manufacturing and waste-to-value, food systems and land use, as well as the mitigation of climate change and adaptation to its consequences. All along the value chain. These shifts are tail winded by a mix of incentives and sticks, from the reshoring of these systems of production in the west to recent shipping lane distributions.

Where to invest, and not to invest

In a capitalist framework, the winning solutions are those that combine low cost with high scalability, and durability, as these characteristics are essential for impactful, large-scale economic advancement. The most efficient methods of production will be the ones adopted. Relying solely on wishful thinking of large-scale social change and hopes of government interventionism is not a viable option, both from an asset allocation standpoint, and from a climate standpoint. But connecting businesses with the cost of externalities will shift some of the investment decisions made.

The ventures capturing the largest share of economic returns will have to converge these criteria to deliver on our overarching goal of creating abundant resources at scale. And in a venture capital framework, high ROIC is the the required financial output to achieve venture returns. To do that, we have to focus on the harder problems. Companies solving those will be able to build stronger competitive advantages, eventually being able to expand and capture their entire value-chains to build the leaders of tomorrow’s economy.

Therefore, venture dollars should primarily focus on innovations that are good regardless of climate opinion (ie with high ROIC and potential for scale), with the added bonus of being able to deliver said climate benefits at scale. Not the other way around. Hardware solutions in areas of production and energy will offer potential for large returns as we seek to overhaul our primary and secondary sectors. Bessemer has a good article on the 8 lessons from climate tech 1.0, the first one being to “avoid relying on altruism to scale”.

Another climate investor once shared in conversation that he would only invest in businesses that “a climate skeptic would love to buy from”. This is the exact essence of how scale can be achieved. These clients will strictly care about return on invested capital, time to profitability, and gross margins when making investment decisions. None of the companies that will achieve durable emission improvements over the status-quo will manage to do it with green premiums. Therefore, better unit economics are mandatory.

Many, in Europe notably, have suggested that the change needs to come from consumers restricting some of their consumption patterns. Such as slowing down on plane flights, eating locally and avoiding car travel. While this bridge will surely bring us closer to the right path from a short-term view, it indirectly suggests that restraining recently gained progress is the way forward.

At Bleu, we believe the systems of production (industry, agriculture…) and their inputs (energy, materials) present the largest economic opportunity and potential impact to power that transition. This industrial shift will only happen if the medium to long-term economic benefits outweighs the required upfront capital expenditures.

A final note on hard tech, a vertical I’ve discussed before. Climate targets won’t be achieved with carbon accounting software or ESG data software alone. Most in the venture space would agree. But few have become comfortable enough with the elephant in the room, hardware-first businesses.

I wrote a longer form essay on the topic to explain why I think that any climate investing strategy should be largely made of hardware businesses. By investing in hard tech, we can unlock the potential of a sector that - data from investors like Leo Polovets of Humba suggests - might yield returns comparable to software, given the right understanding and framework. Apple, for instance, only raised $3.5M by the time it went public in December 1980 at a $271M valuation. Not a bad equity to capital raised ratio.

Conclusion

To end this on an inspirational note, the era of sustainable progress is intrinsically linked to the preservation of the essence of the American Dream. In other words, the idea that the next generation’s living conditions will be better than our own, and so on. This depends on the economy’s growth rate, and our ability to reignite America’s growth engine. 3%+ GDP growth will require an acceleration or our industrial production capacity, which is itself dependent on our ability to make it sustainable. We are therefore working for the preservation of this dream for future generations, while reducing poverty.

- Julien