This is the second post in our series exploring the nuclear ecosystem. Carl, founder of Exodys Energy, and I, an investor at Bleu Capital, are translating our regular discussions about this field, from our time as roommates, into articles that simplify its complexities. In our first post, we tackled what we see as a major misstep by venture capitalists in the nuclear sector. Our goal for this series is to be a helpful primer for anyone thinking about starting or investing in a nuclear venture, providing insights that could help shape the future of the industry. For his part, Carl really wants to see advanced reactors succeed and hopes that his learnings can benefit the greater community of builders. Enjoy!

What’s the TLDR:

Nuclear industry is seeing a resurgence of Light Water Reactor (LWR) designs over advanced concepts

Utilities act as 'kings without crowns,' heavily influencing industry trends

Key factors driving LWR preference: Economic efficiencies, regulatory familiarity, operational standardization, insurance considerations

Industry faces potential 'winner-takes-all' scenario for advanced designs

Venture capital allocation to multiple reactor designs may not be the most efficient strategy; Doubling down on the one design and focusing on non-reactor innovations (materials, fuel, control systems) could offer more immediate returns

The nuclear sector's recent history reads like a classic rock reunion tour. In a striking twist of technological déjà vu, blueprints from the 1970s have been dusted off, breathing new life into reactor designs.

And like many founders in the space, Carl’s singular focus when launching his first reactor company Elysium was to find the best possible design - one that would combine passive safety features, capital efficient modular construction, and energy output efficiency. He assembled a team of world-class nuclear designers from the US Naval Reactor program, landed on a technology, and raised early-stage capital to build the first Molten-Salt reactor in half a century.

But the field of dreams approach was not the right one, and Elysium ultimately fell in the category of great designs that remained just this - designs. By his own accord, Carl did not fully grasp the size of the iceberg underneath the at-surface utility.

It is not to say that Elysium did not engage with stakeholders, on the contrary! It was the first thing they did when figuring out which reactor type to work on. The wish list consistently included:

Passive safety to address the cost of active safety systems and the risk of human error.

Lower Levelized Cost of Energy (LCOE) compared to ongoing projects at the time (AP1000s in South Carolina and Georgia, EPR at Flamanville).

A nuclear waste disposal solution.

However, several reactor designers have only focused on one or two wishlist items, instead of all three. Admittedly, wishlists can change over the years and vary by client, however from our experience these three points remain a constant theme - specifically safety.

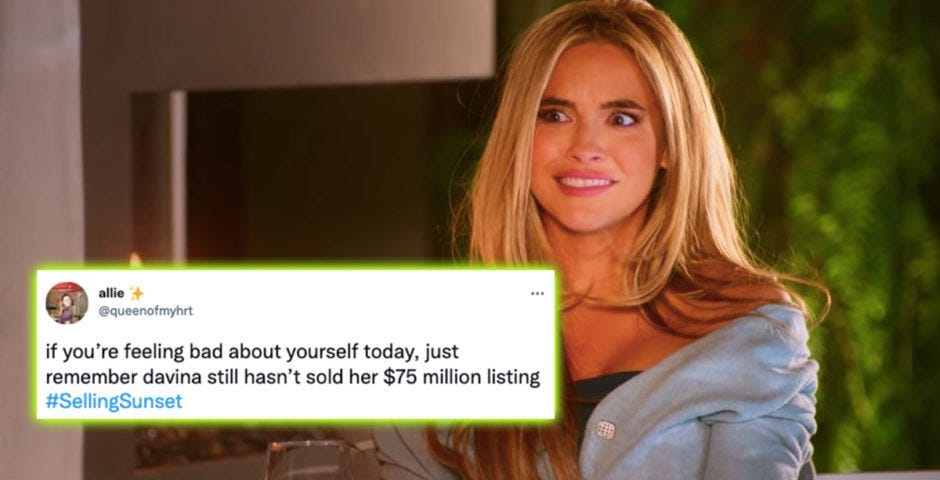

At this point, you might be wondering what Netflix's "Selling Sunset" could possibly have in common with the nuclear sector. Surprisingly, quite a bit. Just as a novice real estate agent might assume the most impressive house will effortlessly attract buyers, Carl initially believed that the reactor with the best technical features would naturally rise to the top, with stakeholders falling in line to support its development. However, he soon discovered that the nuclear industry, much like the high-stakes world of luxury real estate, is driven by a complex web of interests, regulations, and market forces that extend far beyond mere technical specifications.

The improved understanding of a client’s bandwidth and structural limitations, in contrast to its wishlist items, took several years to metabolize – just as it is still taking years for utilities to wrap their heads around what to make of advanced reactors. In Carl’s scenario, he came for the thorium and left with liquid-fuel Molten Salt Reactors (MSRs). In a similar vein, utilities have evolved their perspective on nuclear capacity expansion since 2014-2015. While the surge of advanced reactor developers initially sparked interest, it seems to have led to an unexpected outcome. Rather than embracing these new technologies, utilities appear to have gained a renewed appreciation for the Light Water Reactor (LWR) technology, already available in their arsenal.

Let’s dive in.

LWRs: Back to the Future

As more incumbents started proposing smaller versions of their existing LWRs, reality hit Carl. Over the years, these established reactor vendors have progressively locked in multiple pieces of the value chain, creating MOATs across the board, and building strong relationships with utilities. And while government support – such as DOE’s Advanced Reactor Demonstration Program (ARDP) – has been invaluable to the next-gen reactor designers, the bulk of government funding has gone to the more traditional vendors. These companies have brilliant personnel, distribution infrastructure, and product diversity to out-compete any other startup or small business, but with no bankability or experience as a capable contractor. The incentive structure of the market was working against innovation, not for it.

In recent years, utilities have been evaluating next-gen reactors as their fleet is growing older. A great example is Ontario Power Generation's (OPG) rigorous selection process, which pitted three distinct reactor concepts against each other: a molten salt reactor (Terrestrial), a high-temperature gas reactor (X-Energy), and the more classically designed LWR (GE-Hitachi). After at least 7 years of reviewing the landscape, who do you think they chose? GE-Hitachi was announced as the selected vendor in December 2021. Instead of going for innovative and more radical designs that could offer improved results across all 3 major attributes, the utility ended up selecting a scaled-down LWR.

OPG's decision rippled through the industry, influencing SaskPower's own reactor selection process. After a four-year review mirroring OPG's approach, SaskPower narrowed their choices to the same three vendors. On June 27, 2022, they aligned with OPG, selecting GE-Hitachi's BWRX-300. This pattern reveals utilities' preference for 'comfort' and fleet standardization, prioritizing supply chain efficiency over individual pursuits of innovation.

And to make matters more interesting, another company has retroactively joined the SaskPower race: Westinghouse with its AP-300 and AP-1000 - now under consideration. Yet another ”classicold-school” Light Water Reactor. Ultimately, utilities sell affordable and reliable electricity, and that is how they create their brand – not by purchasing the most innovative state-of-the-art technology.

Fast forward to April 2023: The Great British Nuclear program launches to select the best SMR vendor for expanding generating capacity in the UK. This time, the intent is clear: 6 LWR vendors are selected. No other design approaches. After that, several other countries in Europe followed suit; Poland announced in December 2023 the potential deployment of 24 BWRX-300s at 6 different sites. And finally, the DOE issued a Notice of Intent (NOI) on June 17, 2024, to invest $900 million more in LWR SMRs, solidifying the industry’s trajectory.

On July 25, 2024, a landmark collaboration was brought to life: 17 companies from 11 European countries announced their decision to establish a working group within the European Industrial Alliance on SMRs, solely dedicated to the deployment of the GE BWRX-300. This strategic alliance promises multiple benefits: a shared supply chain and collective sharing of learnings. This move represents a significant shift towards efficiency and cooperation in the European nuclear sector, with the BWRX-300 as the centerpiece of their unified approach.

As we write this article (August 29, 2024) China just announced the approval of four new Westinghouse AP-1000 reactors, expanding its fleet to 16 units, highlighting a key advantage of classical Light Water Reactor (LWR) designs: superior exportability. LWRs, with their long operational history, face fewer international hurdles. In contrast, advanced nuclear developers like TerraPower find themselves locked out of major markets due to geopolitical tensions. This exportability edge significantly influences global market dynamics and utility choices, favoring established LWR technologies.

Customer is King (without a crown)

Utilities' recent decisions favoring Light Water Reactors (LWRs) over advanced designs stem from a complex interplay of economic and operational factors.

A fundamental reason behind the reduced excitement for advanced reactors is the higher cost associated with any non-LWR concept. Traditional Levelized Cost of Electricity (LCOE) calculations do not reflect the internal cost of multi-annual technical due diligence and operator training programs that are typically accredited by external institutions (e.g. Institute for Nuclear Power Operations). In the past decade alone, US nuclear plants have slashed Operations and Maintenance (O&M) costs by over 30% thanks to unified best practices. Introducing a diverse array of reactor types would jeopardize these hard-won efficiencies.

Another weight on the scale lies in the need to get insurance coverage - paramount when acquiring major assets such as nuclear reactors or a $75 million home. Insurers like Nuclear Electric Insurance Limited (NEIL) or American Nuclear Insurers (ANI) require comprehensive understanding before providing coverage – a non-trivial process due to the potential technical complexity associated with new designs. Without insurance, deployment is impossible, regardless of utility or Public Utility Commission support.

The Price-Anderson Act of 1957 offers crucial protections in case of major nuclear accidents. Additionally, the Nuclear Regulatory Commission (NRC) regulations (10 CFR 50.54(w)) mandate $1 billion minimum on-site insurance per reactor site - a requirement stemming from the 1979 Three Mile Island incident. While these figures may evolve with the advent of smaller reactors, insurers' willingness to cover new reactor types remains a critical and distinct consideration in the deployment process.

Finally, utilities, keenly aware of regulatory preferences, strategically optimize their reactor choices to align with these inclinations. Regulators, like many professionals, gravitate towards the familiar. When faced with existing technologies - essentially scaled-down versions of proven reactor designs - they're on comfortable ground. They know exactly where to look and what to scrutinize. However, a completely novel design introduces a level of uncertainty that can be frustrating, especially when applicants and regulators don’t share the same base assumptions..

The unspoken fears of signing off on new technology may cause a retreat to the safety of the known. It's reminiscent of the old adage in finance: 'No portfolio manager ever got fired for recommending IBM stock.' In the high-stakes world of nuclear regulation, the path of least resistance often leads back to established technologies, and utilities astutely factor this into their decision-making process.

In light of these challenges, utilities emerge as the de facto 'kings' of the nuclear industry. They wield significant influence over reactor choices, operational strategies, and deployment decisions.

One Customer, Multiple Stakeholders

Despite the clear trend towards LWRs, utilities continue to invest considerable time, resources, and intellectual capital into exploring advanced nuclear concepts. This apparent contradiction reveals a fundamental tension within these organizations. On one side, their innovation departments are drawn to the potential of next-generation reactors, seeing opportunities for improved efficiency, safety, and sustainability.

However, when it comes to actual implementation, utilities find themselves constrained by the realities of their operating environment. The gap between 'what we want to do' (as envisioned by innovation teams) and 'what we can do' (as dictated by economic, regulatory, and operational realities) is often substantial. This disconnect stems from the complex ecosystem in which utilities operate, where multiple stakeholders, regulatory hurdles, and financial considerations all exert influence on decision-making processes.

The result is a kind of institutional cognitive dissonance. Utilities continue to engage with and invest in advanced nuclear concepts, driven by a genuine interest in innovation and a desire to stay ahead of industry trends. Yet, when it comes to concrete decisions about reactor deployment, they often find themselves pulled back to the familiar territory of LWRs by the gravitational force of practical constraints.

To understand this paradox fully, we must delve deeper into the many forces at play in the utility decision-making landscape.

The first step is understanding whether a client operates in a regulated or deregulated market. In a regulated market, the Public Utility Commission/Public Service Commission sets the rate for electricity consumers and must approve any modification or shift of the utilities’ costs (e.g. upgrades, refurbishments, expansion) to ratepayers. In addition, PUC/PSCs are also active in deregulated markets where they serve as an ethical steward for their electricity consumers. No matter which market you are planning to operate in, you will need to get their approval.

In regulated markets, that approval is even more difficult to obtain as you must demonstrate that your solution will not adversely affect ratepayers, with a laser focus on potential construction delays, cost overruns, and unexpected O&M costs for a FOAK unit. The second step is to ask yourself: “How many municipalities or states are purchasing electricity from the proposed plant?”. If there are multiple, all its PUCs/PSCs need to approve this decision. Much more complex than having to convince just one!

One cannot help but draw parallels with NuScale’s Utah Associated Municipalities Power Systems (UAMPS) project. When the project’s cancellation hit the newswire, the focus was almost exclusively on NuScale’s performance as a vendor and escalating costs. Most vendors distanced themselves from this eventuality by citing different aspects of their products.

In all fairness, most of these cost escalations were largely driven by bull-whipped global supply chain factors affecting all companies in all industries. This is also due to the maturity of NuScale’s numbers as well, since they were among the few to be at the final detailed design phase. Not enough attention or warning has been heeded on the existing structure of such clients and how this may affect future vendors.

As evoked with SaskPower, being selected is the beginning of an even longer confirmation process. UAMPS serves 50 members (principally municipalities) in 7 different states. Given the amount of touchpoints and off-ramps available throughout project planning, it is quite the undertaking to keep everyone on board for over a decade. The majority of UAMPS may have very well desired to continue the project, but a minority opposition can truly end it.

Finally, while the NRC oversees the civilian nuclear sector federally, state-level regulations can override or complicate federal approvals. For instance, despite NRC authorization, New York State banned tritium discharge during the Indian Point NPP decommissioning, forcing Holtec to alter its strategy. Similarly, NRC-approved consolidated interim storage facilities in New Mexico and Texas were halted by state governors.

Initiatives like Nuclear New York, the Texas Nuclear Alliance, and the Ohio Nuclear Development Authority have become crucial venues for multi-stakeholder engagement. These platforms reflect the complex landscape utilities must navigate, often leading them to favor proven technologies with established track records of regulatory approval and community acceptance. This reality further elucidates utilities' inclination towards familiar LWR designs, as they seek to minimize regulatory hurdles in an already complex decision-making environment.

Venturing beyond the utility

This challenging landscape has spurred innovation in deployment strategies. Several reactor vendors are now exploring an alternative path: focusing on smaller reactors for remote locations where they can serve as the operator.

This approach cleverly sidesteps many of the hurdles faced when dealing with traditional utilities. It reduces the uncertainties associated with integrating novel reactor concepts into existing workforce training programs, even for designs that are theoretically simpler to operate. Moreover, it alleviates the complexity of connecting to overcrowded transmission systems and opens up new markets, allowing reactors to compete in industrial process heat applications currently dominated by diesel generators.

Despite these hurdles in the existing framework, utilities retain several structural advantages: they possess well-staffed legal teams interfacing with all aforementioned stakeholders (especially NRC-focused staff), robust human resources/workforce training capabilities, and quite the balance sheet. In fact, Southern Company used their assets as collateral to secure credit from the DOE Loan Program Office for the completion of Plant Vogtle’s Units 3 and 4. Although there are many LOI/MOUs being signed with non-utility clients (e.g. chemical production companies), there is a real chicken and egg scenario between securing an underwriter and obtaining a signed contract without a utility’s structural support.

The surge in data center demand, driven by artificial intelligence advancements, has created new opportunities for Small Modular Reactors (SMRs) to enter the market directly, potentially bypassing traditional utility 'sponsorship'. However, this emerging sector also presents intriguing prospects for established utilities. Data center providers face a critical decision: should they locate near existing utility-operated nuclear power plants in industrial parks, or develop self-contained campuses with dedicated nuclear-powered mini grids?

Meanwhile, utilities are leveraging their existing assets innovatively. Over the past decade, 23 reactor units have successfully applied for power uprates, adding approximately 1,000 MWe to U.S. generating capacity - an average of 40+ MWe per reactor. These upgrades, achieved through equipment enhancements or fuel loading modifications, demonstrate utilities' ability to increase output without investing in entirely new reactors.

The Nuclear Centaur(y)

Utilities, with their deep wells of technical expertise and regulatory savvy, are uniquely positioned to serve as both mentors and incubators for innovative reactor designs. A path forward could be to have utilities offer their sites as testing grounds for First-Of-A-Kind (FOAK) reactors, thus becoming the nurturing 'landlords' of tomorrow's nuclear technology. This arrangement could not only mitigate the operational hurdles faced by nascent reactor vendors, but also cleverly sidestep the regulatory concerns of risk-averse Public Utility Commissions - with the caveat that the target customers are not the utility’s ratepayers but the non-utility customer to assuage the fears of risk-averse consumer-focused PUC/PSCs.

Utilities can also be excellent consultants for reactor vendors when it comes to regulatory support and making sure all Ts are crossed and Is are dotted. Hiring former utility executives is one way to do so. However in many large organizations, there is informational asymmetry between certain departments (a root cause of corporate inertia!). In-kind contributions are great, but you get what you pay for.

As the industry evolves, standardization will also continue to play a crucial role. The advantages of fleet standardization, already evident in the LWR sphere, will likely extend to advanced designs. However, it's important to recognize that this trend towards standardization may have far-reaching implications for the future of nuclear innovation.

If history is any guide, when the door to advanced reactor deployment finally opens, it may not accommodate the multitude of designs currently in development. Instead, we might witness a phenomenon similar to the renewed diffusion of LWRs – the replication and standardization of a single successful advanced design across the board. This 'first-mover advantage' could be decisive, potentially narrowing the field of viable reactor concepts more rapidly than many anticipate.

Given this reality, the current allocation of venture capital to a wide array of reactor designs, each facing a decade-long path to market, may not be the most efficient strategy. Instead, we should broaden our perspective on innovation in the nuclear sector. So, should we collectively shift our focus to the vast array of innovations happening beyond reactor design? Many of these advancements are already being implemented in operational reactors. From advanced materials and fuel designs to cutting-edge control systems and maintenance techniques, there's a wealth of innovation potential that doesn't require betting on a single reactor concept.

This approach not only hedges against the risks of the 'winner-takes-all' scenario in reactor design but also offers more immediate returns on investment. By focusing on innovations that can be applied to existing reactors as well as future designs, we can drive progress in the nuclear industry regardless of which advanced reactor concept ultimately prevails.

-Carl & Julien

Thanks for explaining why fast reactors are so slow getting approved. I love the idea of reusing nuclear waste and thereby reducing the final waste by about 10X, so I'm a real fan of advanced and fast reactors and I hope they can overcome the inertia towards the old light water reactors soon.

I largely agree about the future dominance of LWRs, with one caveat. At some point we're going to need at least one higher-temp reactor desgin to handle industrial process heat applications.