Nuclear's Picks and Shovels - Part 1

Finding opportunities beyond the reactor island.

These days, there's something quite special in the air about nuclear power. Positive news arising one after the other, progressively confirming the hypothesis that nuclear reactors will be an essential component to accelerate the energy capacity ramp-up necessary to support electrification, specifically on the rising needs of energy from data centers and artificial intelligence.

Perhaps the most symbolic of it all is Pennsylvania's Three Mile Island plant reopening, backed by a new partner, Microsoft. The plant was initially shut down in 2019, although its name is associated with the 1978 partial meltdown that drummed up existential fears around civilian nuclear incidents. Its transition to becoming a symbol of nuclear's resurgence is a beautiful sight.

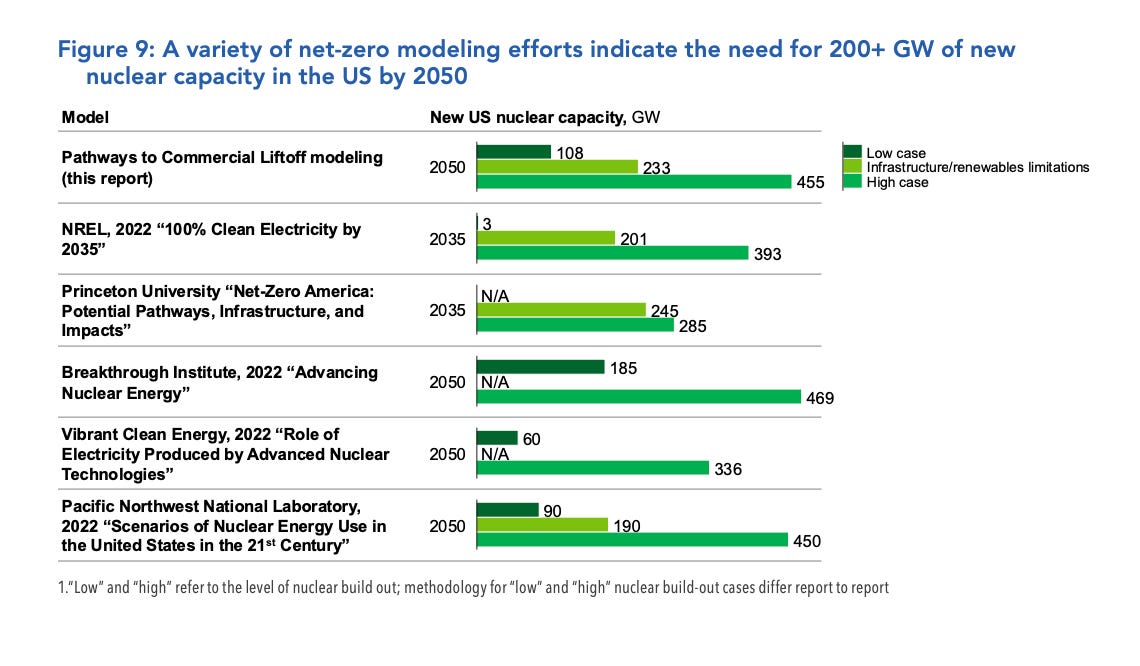

As a result, fleet expansion is becoming an increasingly important priority for utilities. According to the DOE‘s latest Liftoff report on “advancing nuclear”, a tripling of current nuclear capacity will be required to reach 200+ GW of nuclear power by 2050 - A baseline value for the output needed to achieve the current administration’s decarbonization targets.

And despite the complexities outlined in our previous article on selling reactor designs, the reality is that these utilities do support advanced reactor deployment. While we haven't seen that shine through recent reactor selection processes (Ontario Power Generation, SaskPower, and the Great British Nuclear Program - each selected light water reactors from GE-Hitachi), new advanced reactors are finally entering the deployment stage, with TerraPower breaking ground on its first reactor, Dow Chemical’s commitment to purchase X-Energy reactors, and Google inking the world’s first corporate purchase of advanced reactors with Kairos Power!

These advanced reactors will require critical inputs and requirements that will stress-test our existing value chain, on a <10 year horizon. The nuclear industrial base will need to be dusted off to support this growth, with significant upscaling across the value chain.

From an investor perspective, a lot of value will evidently aggregate at the reactor vendor level. New reactor designers / vendors have captured most of the private capital being raised in the space, but there are lower-hanging fruits with less financial and technical exposure that provide similar upside opportunities in an effort to capitalize on the ongoing nuclear resurgence.

With Carl, we wanted to shed the light on 3 of the most important investment opportunities in nuclear today beyond the reactor design. Each category captures an essential foundation for the age of advanced nuclear power.

The first opportunity comes from the need to rebuild the nuclear workforce.

First, let’s set the stage: The nuclear industry currently employs 100,000 people in the U.S, supporting roughly 100,000 GW. Each power plant requires between 400 and 800 personnel to operate.

But the landscape is shifting—union dynamics, retirements, and a shrinking talent pool have revealed the vulnerabilities around the nuclear labor force.. According to the DOE, 2 of the 4 major reasons for timeline slippages in reactor construction are systemic issues related to the workforce. Furthermore, the central argument regarding the financial benefits around advanced reactors are the economies of scale. In other words, the ability for personnel to learn from prior (and recent!) iterations. For instance, Westinghouse AP-1000s being built abroad bring some level of component standardization, however they don’t leverage the same workers from the Vogtle project.

For nuclear engineers and operators, the picture over the last 40 years hasn’t been great, with the overall message being that 1) the US wouldn’t be building new reactors and 2) media coverage has largely been in favor of a decrease in existing nuclear fleet size following notable incidents such as Fukushima.

At the university level, only 28 reactors remain open out of the 64 that were active in the 1960s. Stanford released an excellent paper on shrinking nuclear programs - Highlighting that 50% of nuclear faculty members in the US are above 50 years old (as of 1998) and may cause more program closures. For the most part, nuclear engineering departments have been folded into larger engineering programs, if not removed.

The DOE projects a need for 300,000 employees by 2050; tripling the current workforce in line with capacity growth. This presents quite the undertaking, particularly for highly specialized roles like metal workers, welders, and electricians. The timeline for workforce development can be extensive:

Basic certification programs: 2-3 years

Specialized nuclear training: 1-2 years

Additional certifications (e.g., American Society of Mechanical Engineers for welding): 6 months - 1 year

On-the-job training: 2 years of supervised work

Starting now, it could take 5-7 years to produce the first cohort of fully trained workers. Consequently, from a workforce perspective, advanced nuclear reactor construction at an industrial scale is unlikely to begin until the early to mid-2030s. For roles requiring bachelor's degrees, such as design engineers, the timeline may be even longer.

This applies a significant pressure on both builders and operators, opening the door for accelerated adoption schedules for technologies that can help mitigate those pressures.

The way forward is going to require an evolution of our approach to staffing in this increasingly complex environment. New reactor vendors are already integrating this reality into their plans by planning for lesser to sometimes minimal human management at the site level. But legacy players will have to adapt too.

Amongst all of this, we see giant open doors for companies helping address those shortages, starting today.

1: Redesigning workflows

Task automation in an otherwise mostly analog run industry with high levels of redundancy, is bound to happen. We see value in automating tasks that are inherently boring, repetitive, and require the review of vast amounts of data. It’s a fairly decent guideline to figure out what could be automated in this space.

We’re already seeing applications for generative AI in decision-making: Nuclearn is an interesting early use case on what could be done in that field with applications such as fixed asset classifications paving the way for adoption. Their entry point focuses on tasks that require large data ingestions and processing, with the ability to automate 75% of corrective action issues. The models are fine tuned on existing corrective action data from operators. While not entirely removing the human employee out of the equation, it allows a more expedient provision of results and narrows the impact of certain human-caused miscalculations..

In practice, we recently saw a collaboration between Idaho National Lab and the U.S. Navy. The lab is exploring crew reduction strategies, inspired from the Zumwalt-class destroyers’ success in reducing its crew size from 350 to 140. The ability to integrate critical safety functions, and stringent operational requirements is what makes this proxy a great use case.

Automating administrative work is inevitable to enable leaner staffing, allowing plants to operate efficiently with fewer on-site personnel. There will also be opportunities to improve training with augmented reality tools, notably for roles in construction and maintenance that require faster ramp-ups and encounter more employee turnover.

Using augmented reality also allows off-site personnel to provide greater support during construction and/or maintenance outages, which in turn enables engineers at HQ to help multiple sites at once and hone in the economies of scale. Again, we are likely to see a redistribution of roles between central HQs, monitoring multiple smaller sites at once and local field teams.

2: Reporting automation

Henry Ford once said that the “easiest of all wastes and the hardest to correct is the waste of time”. Nuclear has a lot of it, stemming from a perfect mix of decades-old requirements and analog technologies.

A significant chunk of time and resources is tied up in reporting. The current process is labor-intensive—issues are reviewed, classified, and assigned by dozens of people in each plant, with the workforce spending countless hours each week sifting through reports and obtaining each others’ signatures, as required by their Quality Assurance programs. This slows down operations, which can add up to hundreds of millions of dollars in employee hours over time and across multiple assets.

The Government Accountability Office recently noted the Nuclear Regulatory Commission’s (NRC) difficulties in retaining and hiring for the staff needed to approve future regulations, review the applications of new companies, and keep up with all the paperwork from existing plants. This is without accounting for the future tripling in capacity.

Startups like Atomic Canyon can improve those workflows, starting with regulatory filings, by using the vast amount of data available in agency-wide documents. Everstar takes a similar approach with design submissions. Given the number of companies starting to seize the opportunity here, we can imagine that we will see more and more companies flourish further down the value chain as the bulk of new nuclear vendors shift their focus from design and applications through building (2-7 years?) and finally to operating (7+ years?).

The automation of licensing applications has a significant total addressable market: The World nuclear association estimates that costs to support the licensing process can go up to $180-$240M per design, per country. The fees paid to the NRC for application review represent a minute fraction of what is spent by vendors in-house preparing the applications and fulfilling requests for additional information (RAIs)..

Tools like MIRACLE (Machine Intelligence for Review and Analysis of Condition Logs and Entries) —the government is SO good at acronyms, less good at music selection as you’ll see in the video below —are already leading the way. It creates a dictionary of possible topics, labels reports, understands context, and assigns tasks with precision. Other solutions will emerge to help boost overall efficiency across other parts of the workforce.

3: Autonomous robotics and advanced systems

The use of robots in nuclear operations is not new, per se. Remote manipulator arms were developed for use in hot cells and fuel reprocessing activities as early as the 1950s. At the government's Hanford nuclear facility in Washington State, an arm mounted on a transporter with cameras and lights made its debut during this period.

Robots have also been employed at various times at Three Mile Island (TMI) since its accident. In August 1982, a 25-lb (11-kg), remotely controlled, tracked, tank-like vehicle called SISI (System In-Service Inspection), supplied by the Department of Energy (DOE), was used to photograph and obtain radiation readings in areas surrounding the plant's water makeup and purification system.

In recent years, robotics for nuclear has regained traction. The strongest catalyst for the adoption of robotics in the nuclear industry has been the rising need for decommissioning work, creating use cases for operations in hazardous environments and waste removal. Of the current 440 reactors in operation worldwide, 200 are expected to go offline by 2040. The objective is to replace human workers with machines that are more productive, efficient, accurate and can operate in hazardous environments.

Examples have started to flourish in recent years:

Kuka, which has built robots for Tesla's gigafactory, has created minimally modified off-the-shelf robots to help facilitate waste-related tasks.

Tokyo Electric Power Company (TEPCO) is deploying a remote-controlled robot to extract melted fuel debris from Unit 2 of its Fukushima Daiichi nuclear plant.

In the U.S., Argonne National Laboratory has demonstrated a remote-controlled telerobotic system for handling radioactive materials inside a hot cell. It relies on a mixed-reality digital twin platform, combining sensory displays, virtual models, and hardware controls to form a digital representation of tangible objects.

Boston Dynamics is partnering with Ontario Power Generation to deploy its SPOT robots for thermal and visual inspections.

One project worth monitoring is a four-year collaboration between the Engineering & Physical Research Council (EPSRC), the UK nuclear industry, and the Surrey Technology for Autonomous System and Robotics (STAR) laboratory. They are exploring the feasibility of autonomous robots in nuclear decommissioning environments.

Many of the technologies used, including teleoperation and radiation protection for critical electronics, offer interesting transverse use cases such as spatial applications. The same could be said inversely; several companies developing robotics for space can penetrate the nuclear market, and perhaps find a more near-term market and affordable demonstration path.This goes to show how the nuclear industry can benefit from startups working on the same challenges in different industries.

–

Any system is only as good as the culture that went into engineering and deploying it. In order to create this culture, there is a plethora of tools that are currently untapped in the nuclear industry. The examples we cited merely hint at the vast potential for improving operational efficiencies in this everchanging sector. Keep an eye out for parts 2 and 3 of this series, where we'll explore 2 other foundational elements powering nuclear Energy 2.0.

If you are building in any of the areas above, or interested in learning about your product/service’s ability to support the nuclear sector, we would love to connect: Please email julien@bleucap.com and/or cperez@exodysenergy.com.

Very informative. Things are looking up!